PV column

energy

2025/11/11

“Emerging markets become new engines of global energy storage growth: the case of Australia” by InfoLink

While the market for grid-connected batteries is somewhat overheated in Japan, the introduction of energy storage systems (ESS) is progressing even more around the world, with the aim of further introducing and utilizing price-competitive renewable energy (mainly solar and wind power).

This column introduces the current state of energy storage systems around the world through the report “Emerging markets become new engines of global energy storage growth: the case of Australia,” released on October 21, 2025, by InfoLink Consulting, a Taiwanese research and consulting firm specializing in renewable energy and technology.

**********

Emerging markets become new engines of global energy storage growth: the case of Australia

Global energy storage market

According to InfoLink, global new lithium battery energy storage installations are projected to reach 230 GWh in 2025 and may exceed 722 GWh by 2030. The global energy storage landscape has shown a clear trend of diversified growth.

In addition to the three major markets—China, the U.S., and Europe—emerging markets are rapidly expanding and are expected to contribute 18% of total new installations in 2025. Among them, Australia, with its high share of renewable energy, shows strong market potential.

This article focuses on Australia’s energy storage market, analyzing its key drivers and installation forecasts.。

Australia’s energy storage market

Australia is rapidly shifting from coal-fired generation to renewable energy. Its National Electricity Market (NEM) spans more than 5,000 kilometers along the eastern coast, forming one of the world’s longest interconnected power grids. However, the uneven distribution of load centers and renewable energy resources has resulted in a weak grid structure, creating an increasingly urgent need for energy storage.

1. Key drivers

Australia’s strong energy storage potential is primarily driven by its top-down national strategy, genuine grid demand, and a mature market mechanism.

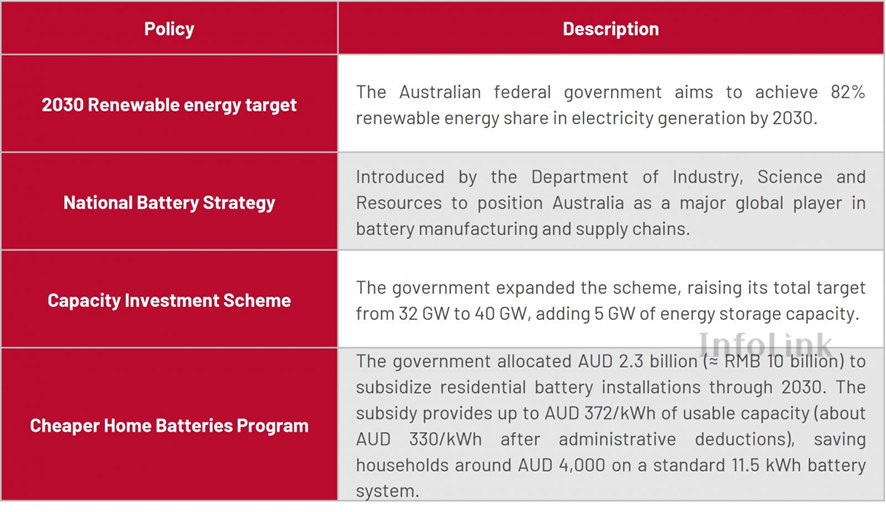

- Policy support: national strategy and incentives

The Australian government aims to achieve 82% renewable energy share in electricity generation by 2030 and has outlined a clear direction via its National Battery Strategy

In August, the government expanded the Capacity Investment Scheme (CIS) to further accelerate capacity growth. In addition, the AUD 2.3 billion Home Battery Subsidy Program, launched in July, has directly boosted end-market demand.

- Fundamental drive: grid constraints and high renewable penetration

Australia’s abundant solar resources in the north are geographically distant from major demand centers in the south, resulting in a geographic supply-demand mismatch. Furthermore, the country’s high rooftop PV penetration leads to significant midday renewable generation, increasing grid pressure from volatility. These structural challenges have stimulated strong and sustained demand for energy storage. -

NEM’s business value: Dual revenue mechanism

Australia’s well-established NEM provides two key revenue streams for energy storage:▪Energy Arbitrage: Leveraging price volatility to “buy low and sell high.” Energy storage system (ESS) charges during midday when solar generation drives prices down and discharges during evening peaks when prices surge. The pronounced peak/off-peak price spread in Australia’s NEM underpins energy arbitrage as a stable and reliable core revenue stream for storage assets.

▪Frequency Control Ancillary Services (FCAS): A defining and high-value revenue stream in Australia’s energy storage market. With millisecond-level response, ESS is ideal for maintaining grid frequency stability. Data from the Australian Energy Market Operator (AEMO) for 2024 indicates that FCAS accounts for 40% of utility-scale energy storage revenues, a share set to grow as renewable penetration rises.

2. Installation forecast

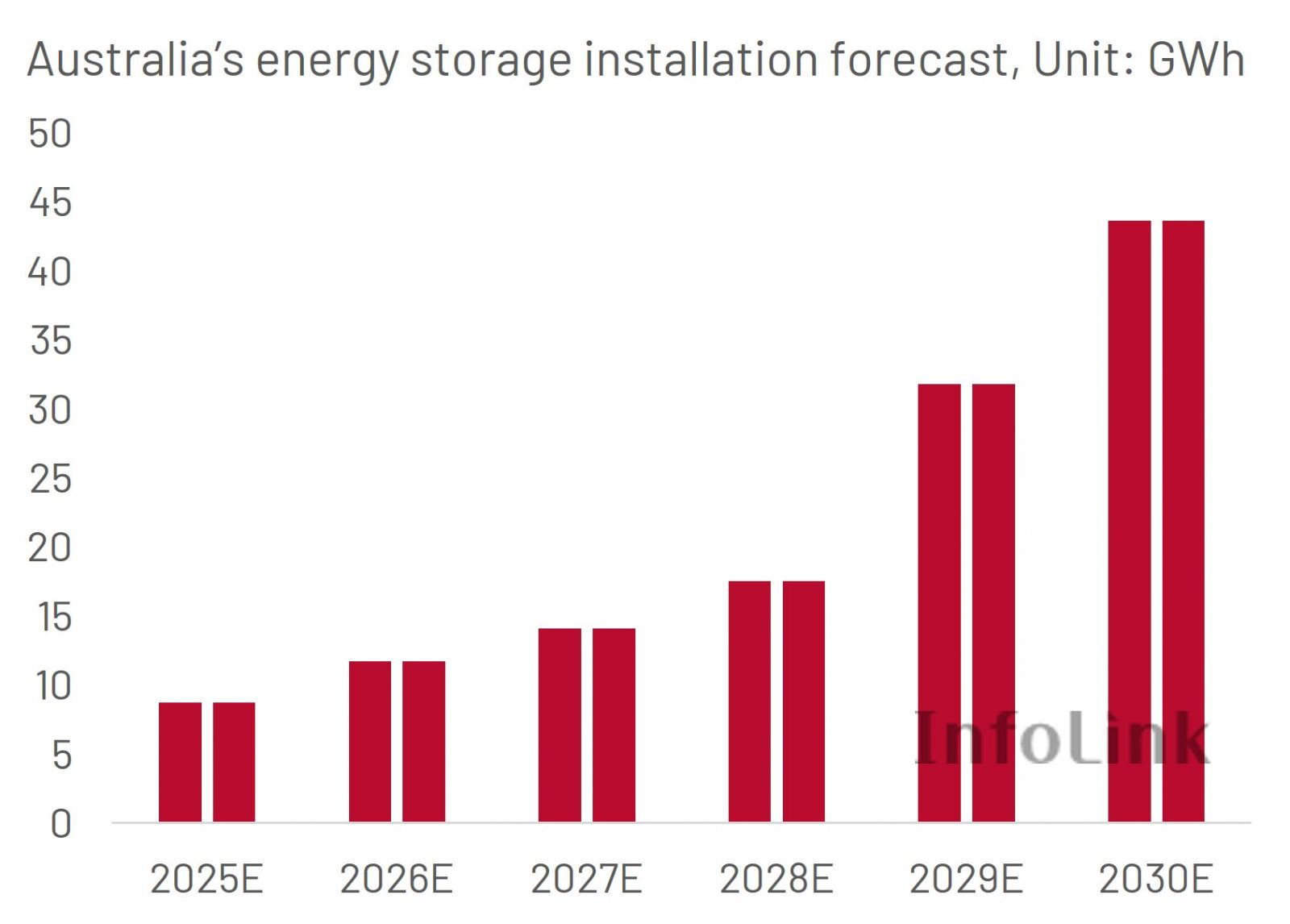

Driven by policy incentives, grid structural challenges, and market-based revenue mechanisms, Australia’s energy storage demand has established a complete and well-defined growth trajectory.

On one hand, national strategies and subsidy programs have accelerated both public utilities and demand for residential storage. According to the latest results from the fourth round of the Capacity Investment Scheme (CIS), 20 projects were awarded, including 12 wind-plus-storage or solar-plus-storage projects totaling 3.5 GW/11.4 GWh.

Following the launch of the federal government’s AUD 2.3 billion subsidy in July, nearly 20,000 new residential systems were installed within the first month, almost 27% of the total installations in 2024, demonstrating strong short-term stimulus from policy support.

On the other hand, electricity price volatility and ancillary service revenues provide a quantifiable commercial foundation. With these factors combined, energy storage capacity growth will become increasingly market-driven rather than subsidy-dependent.

InfoLink forecasts sustained growth in Australia’s energy storage installations, reaching 8.7 GWh in 2025 and potentially 43.6 GWh by 2030. GWh-level projects are increasingly common; InfoLink’s Emerging Market Energy Storage Demand Database shows over five such projects announced in September alone. Planning trends also highlight rising interest in long-duration energy storage, with designs extending up to eight hours or more, though most projects currently remain in the two- to four-hour range.

Despite rapid growth, Australia’s energy storage market faces several challenges. Increasing grid connections have intensified congestion in some regions, extending interconnection timelines and raising costs. In addition, commercial models must further evolve to ensure long-term project viability. As global energy storage demand surges, Australia remains a critical emerging market to watch.

Reference

Emerging Market Energy Storage Demand Database

Gain insights into energy storage market trends and seize strategic overseas expansion opportunities.

**********

In Japan, applications for over 100GWh of capacity have already been submitted for the energy storage system, with installations of 10 to 30 GWh per year expected by 2030. As in Australia, the key to the stable development of Japan’s energy storage system market will likely be the evolution of commercial models and the stable market rules and policies that support them.

Acknowledgments: We would like to thank InfoLink Consulting, Taiwan, for introducing us to this useful article.